Articles

What Happens Once an LRBA is Paid Out?

While paying out a limited recourse borrowing arrangement (LRBA) can free up cash and finally bring in some additional income…

The Pitfalls of Property Valuations – Part 3

Unless an SMSF has invested in property through a limited recourse borrowing arrangement (LRBA), the fund is prohibited from borrowing…

The Pitfalls of Property Valuations – Part 2

Property development in an SMSF encompasses many activities that range from the renovation and re-lease of existing buildings to the…

The Pitfalls of Property Valuations – Part 1

Property development is a popular investment choice for SMSFs because in many cases the returns are greater than investing in…

Navigating SMSF Market Valuations

The current market valuation of all SMSF assets, especially property and unlisted companies, has a significant impact on a member’s $1.6 million transfer balance…

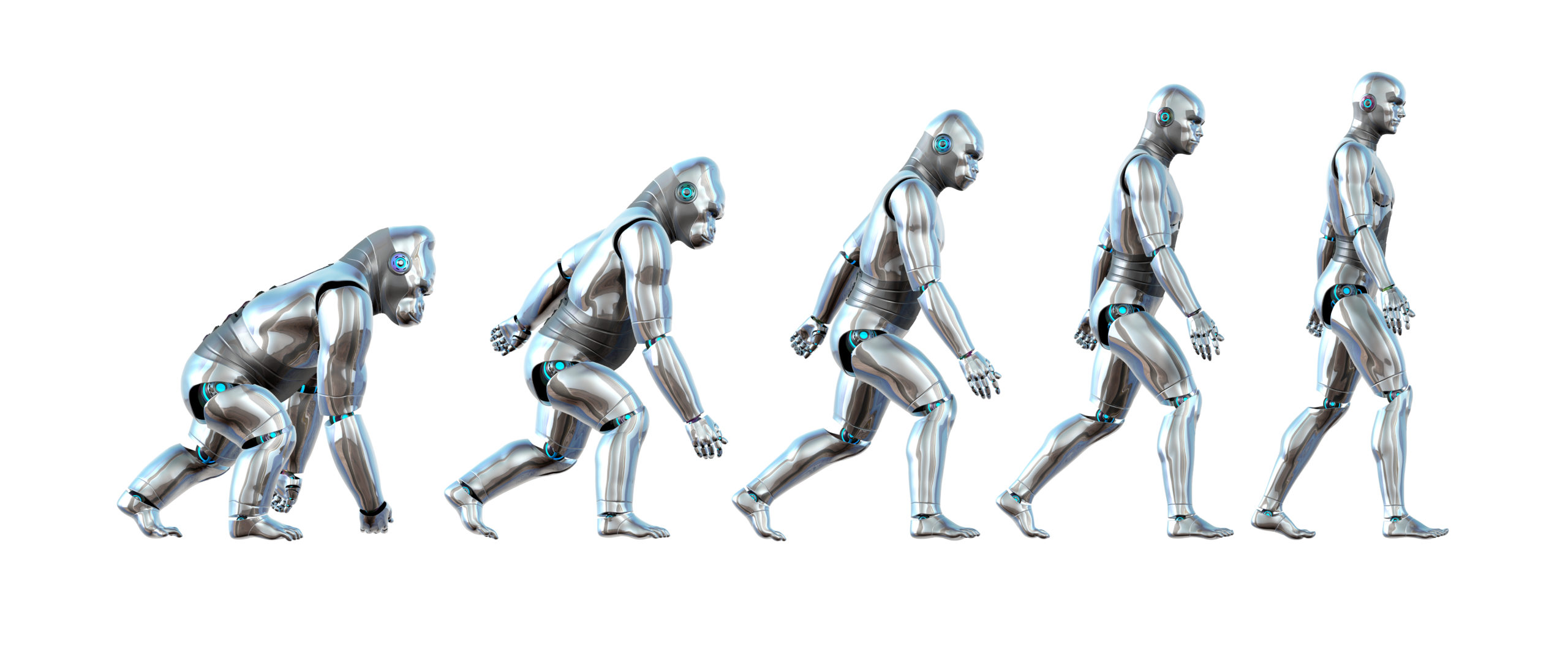

Why Technology Won’t Replace SMSF Auditors

Many SMSF trustees and advisers could be forgiven for thinking that recent developments in technology mean that SMSF auditors no…